Smart industry

致力于为民政提供智慧区划地名、智慧养老及智慧社区信息化整体解决方案。

致力于为应急提供灾害综合风险评估信息化整体解决方案。

致力于利用物联网设施、大数据分析、人工智能、云计算等信息化技术提供新型农业模式整体解决方案。

利用先进的信息和通信技术,对房屋建设、房屋维护、房屋交易和社区管理等领域进行数字化、智能化的改造和升级的一种新型建筑模式的解决方案

通过整合物联网、云计算、大数据、人工智能等技术,实现了城市各个方面信息的快速采集、处理和传输,从而提高了城市管理的效率和质量。

通过整合物联网、大数据、人工智能、云计算等技术,实现了信息的快速采集、处理和传输,从而提高了公安工作的效率和水平。

About Us

9428cn太阳集团,成立于2014年10月,是为信息化领域提供行业智慧化整体解决方案的知名企业,公司注册资金5000万元。公司成立以来,一直专注于民政、公安、应急、农业、自然资源等领域的技术开发、时空服务、智慧标志、系统集成、运维服务,拥有多项信息化领域软件著作权和专利。9428cn太阳集团,是国家高新技术企业和双软认证企业,同时拥有测绘资质、全国标准地名标志产品合格证书,通过质量管理体系认证、信息安全管理体系认证、职业健康管理体系认证、环境管理体系认证,是AAA级信用企业和重合同守信用企业。9428cn太阳集团,总部位于燕赵大地河北石家庄,现有办···

News

点亮智慧应急

华为举办了数字政府应急行业论坛,论坛以“全感知、智指挥、点亮智慧应急,打造‘防救共同体’”为主题,汇聚行业伙伴、业界专家,围绕实际需求、聚焦关键技术,共同探讨新形势下应急管理数字化、智能化转型发展之道。

2024-03-19 阅读详情

国家档案局部署2024年工作:强化档案资政服务 提升多元化服务水平

全国档案工作暨表彰先进会议今天在北京举行。会议指出,2024年将扎实推进档案法和“十四五”档案事业发展规划贯彻实施,统筹高质量发展和高水平安全;加大档案工作数字化转型和现代化建设力度,全面推进档案治理体系和档案资源、利用、安全体系建设,更好地服务推进中国式现代化。

2024-02-23 阅读详情

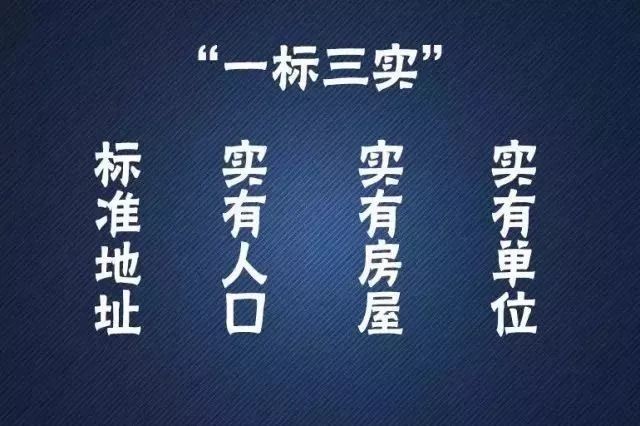

【2024两会看重庆】“一标三实+N” 赋能基层智治

重庆市江津区公安部门在落实全国公安系统推行的“一标三实”(标准地址、实有人口、实有房屋、实有单位,相当于房屋的身份证)数据采集过程中,创新性地将“一标三实”数据融合至数字政府、数字经济、数字社会领域,并打造“一标三实+N”数据资源中台作为基层“智治大脑”,拓宽了基层治理体系和治理能力现代化的路径。

2024-01-24 阅读详情

点亮智慧应急

华为举办了数字政府应急行业论坛,论坛以“全感知、智指挥、点亮智慧应急,打造‘防救共同体’”为主题,汇聚行业伙伴、业界专家,围绕实际需求、聚焦关键技术,共同探讨新形势下应急管理数字化、智能化转型发展之道。

2024-03-19 阅读详情

国家档案局部署2024年工作:强化档案资政服务 提升多元化服务水平

全国档案工作暨表彰先进会议今天在北京举行。会议指出,2024年将扎实推进档案法和“十四五”档案事业发展规划贯彻实施,统筹高质量发展和高水平安全;加大档案工作数字化转型和现代化建设力度,全面推进档案治理体系和档案资源、利用、安全体系建设,更好地服务推进中国式现代化。

2024-02-23 阅读详情

About

关于9428cn太阳集团9428cn太阳集团,是国家高新技术企业和双软认证企业,同时拥有测绘资质、全国标准地名标志产品合格证书,通过质量管理体系认证、信息安全管理体系认证、职业健康管理体系认证、环境管理体系认证,是AAA级信用企业和重合同守信用企业。

Contact

联系我们 石家庄高新区裕华东路358号天山银河广场C区

石家庄高新区裕华东路358号天山银河广场C区

chinazhongkaikeji@163.com

chinazhongkaikeji@163.com

0311-69129988

0311-69129988

|

微信公众号 |

微信客服 |

冀ICP备2023005246号 -1

Copyright © 2023 9428cn太阳集团有限公司 All Rights Reserved.